Scottsdale. Everybody wins. The Market wins

Four auctions, four different formulas, four positive results. Confirmation that there is a desire to move on.

Cliff Goodall's view

Photo credit: RM Sotheby’s, Gooding, Worldwide, Bonhams

Scottsdale has always been the epicentre of the January auctions, but this year, due to Covid-19 there was a revolution during Arizona Week. Some events such as the much-anticipated Barrett-Jackson auction were postponed and those that were held took four very different approaches.

Gooding organized a “Scottsdale Edition” online-only auction, Bonhams remained faithful to the cause with a physical sale in the Westin Kierland Resort, just like last year, RM decided to put on a physical event but changed locations and selected the ultra-trendy Otto Car Club (well worth knowing!), while Worldwide organized their online auction from its headquarters in Auburn, Indiana.

Who made the best choice? And who might benefit from reconsidering their chosen strategy? Follow me and you will discover some real treats.

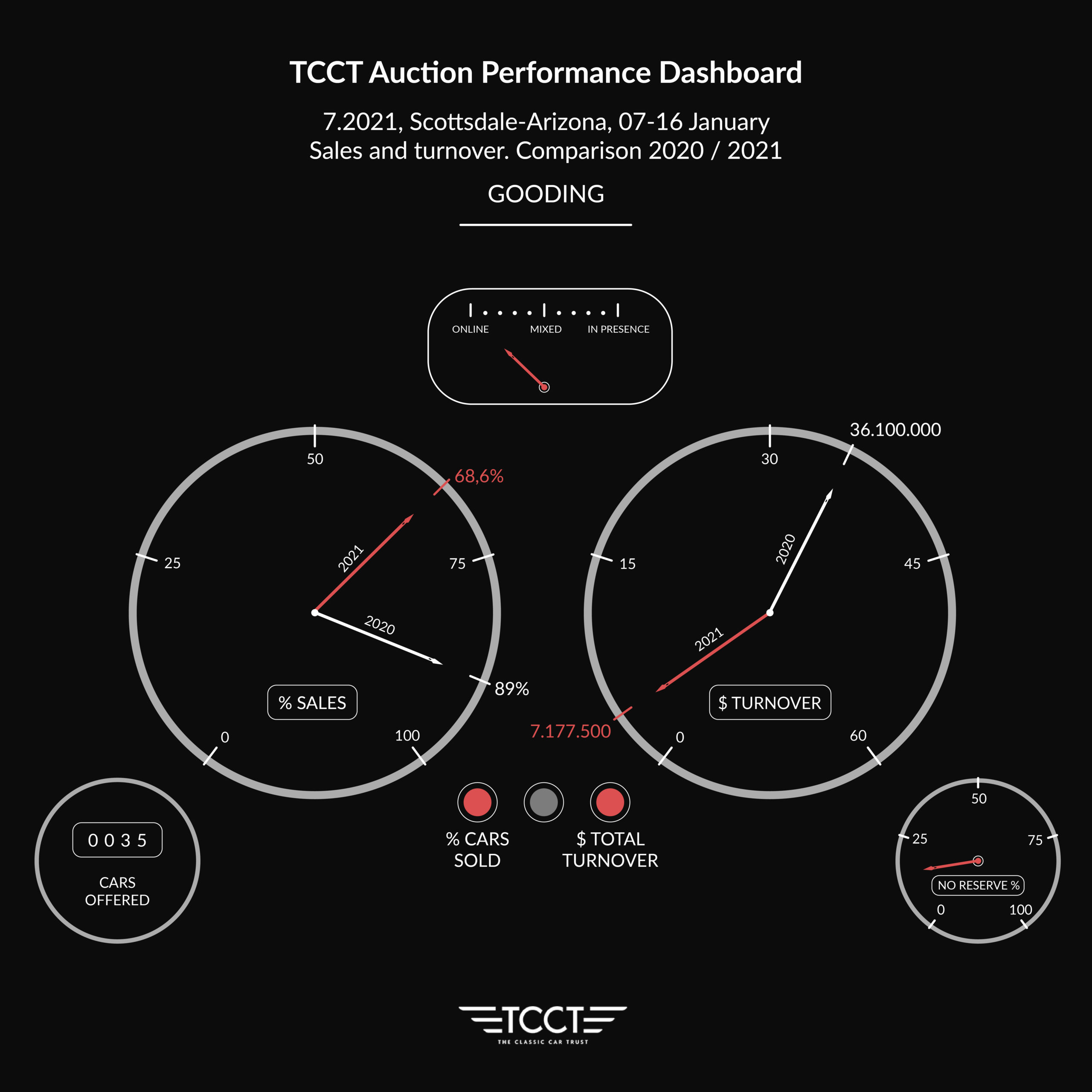

Gooding would appear to be the big loser in this “four-way race”, with our research revealing a turnover of $7,177,500 compared to $36,098,000 received in 2020, while sales percentages plummeted from 89% to 68.6%. So pretty bad then? Well not exactly, because with 24 cars sold compared to 120 last year, the average price remained unchanged, dropping slightly from $300,817 to $299,041. The modest 25% of cars for sale without reserve influenced the sales percentages considerably, particularly as in 2020 that number was 62.5%. Finally, and this is something that needs to be kept in mind, the auction was online, which reduces organizational costs considerably. In conclusion, they were present virtually. And the numbers made sense.

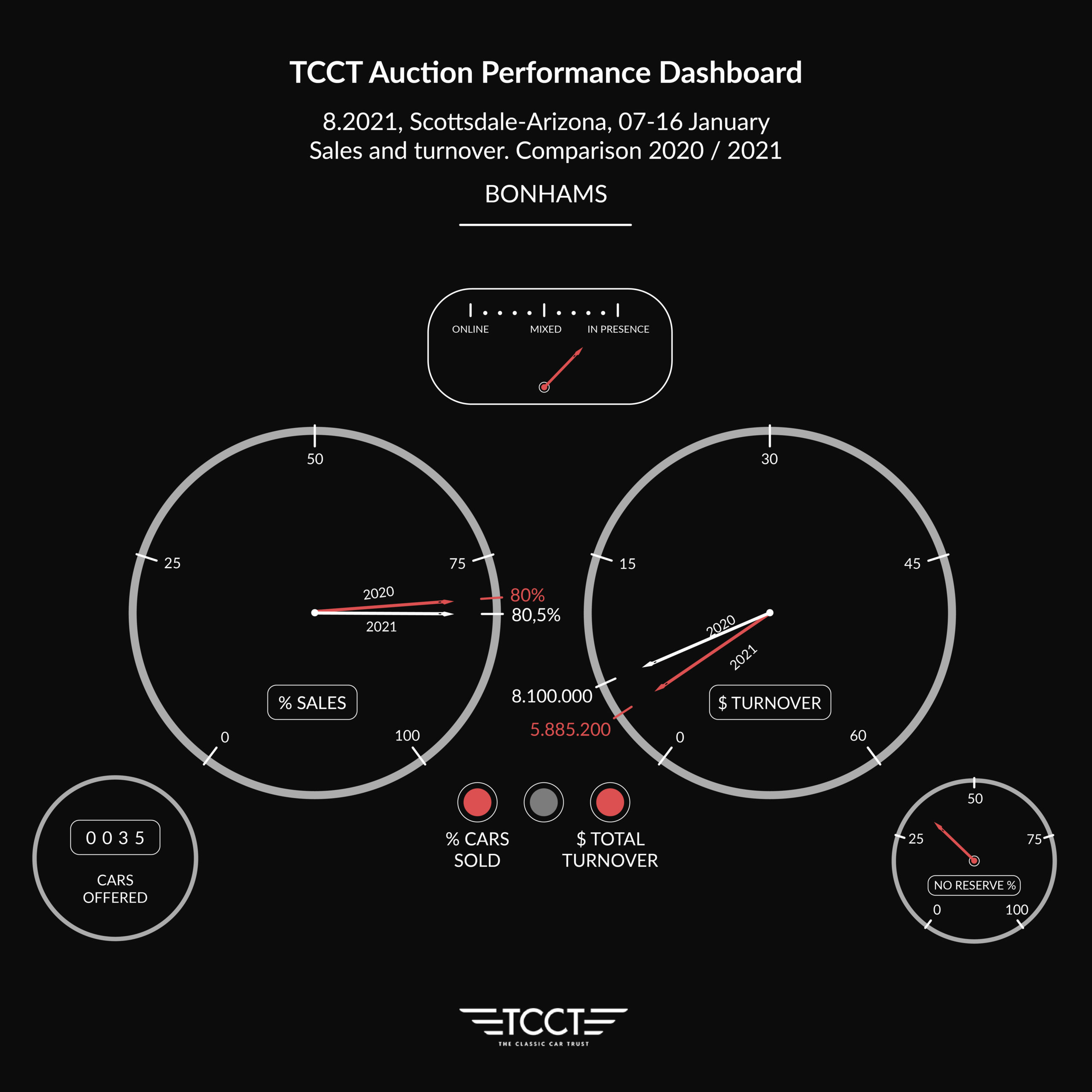

Bonhams closed with a 27% drop to $5,885,200 from last year’s $8.1 million but with a sharp decrease in the number of cars on offer too, from 108 to just 35. But, it should be noted, as they managed to keep the sales percentages stable at around 80% despite having just one third of the cars on offer without reserve (in 2020 that number was 68%), the average price increased dramatically: from $93,103 per car to $210,186 this year. This is something we have been saying for months: a high quality, carefully selected choice of cars that meets the expectations of the market is worth far more than quantity.

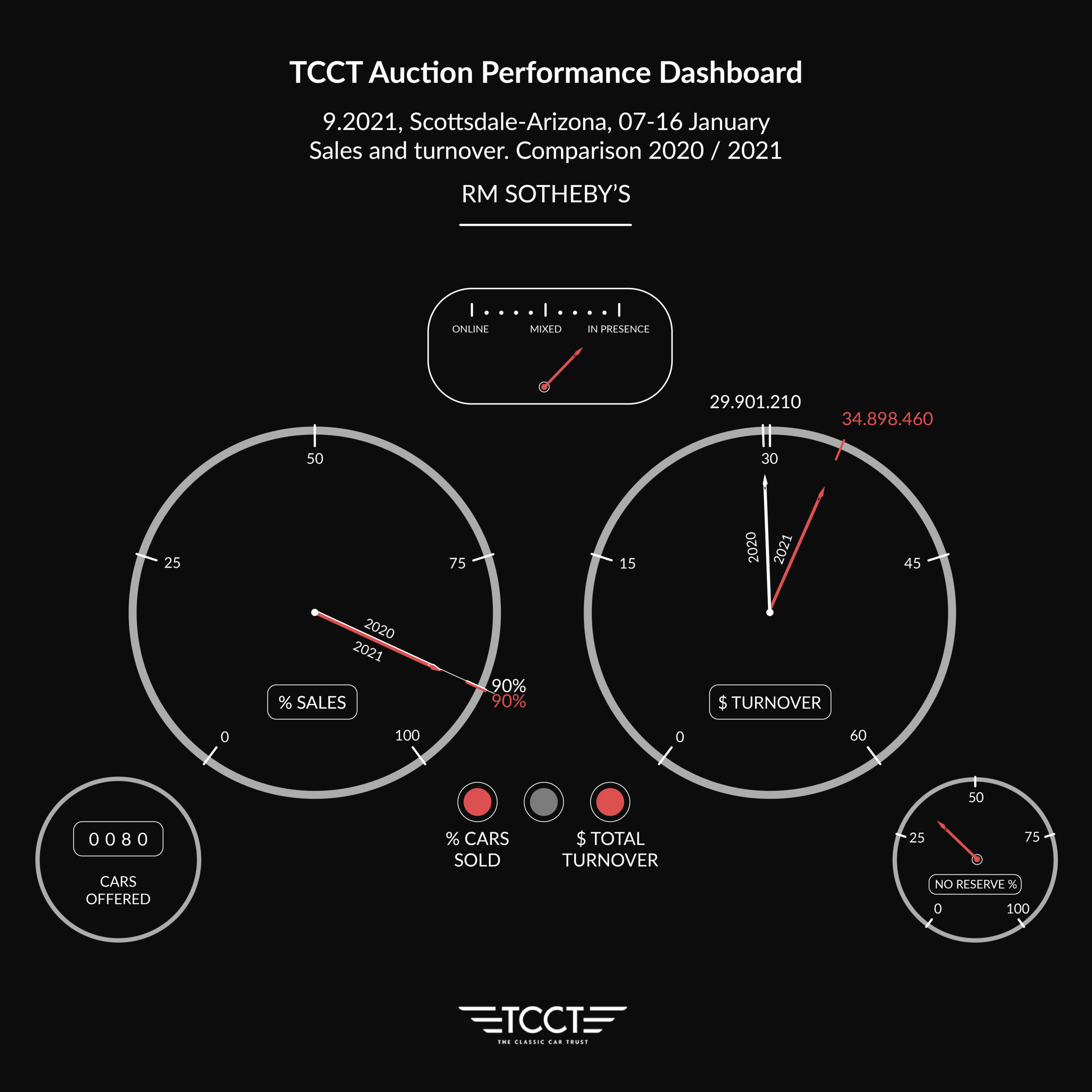

Same consideration for RM that moved from last year’s Arizona Biltmore venue where 138 cars were offered to the far more functional Otto Car Club with space for just 80 cars. The result? Incredible, as the total takings rose by more than 15%. With $34.9 million compared to $29.9 million in 2020, this result is almost counter-intuitive but it was in large part due to the fact that they were able to repropose several Top Lots: with Pebble Beach skipping a round in 2020 and Amelia Island 2021 postponed until May, Arizona proved to be an excellent store window. That explains the presence of two blue-chip pieces like the Jaguar D-Type ($6,000,000) and the Bugatti 57SC ($4,735,000), when last year’s Top Lot went for “just” $2,370,000.

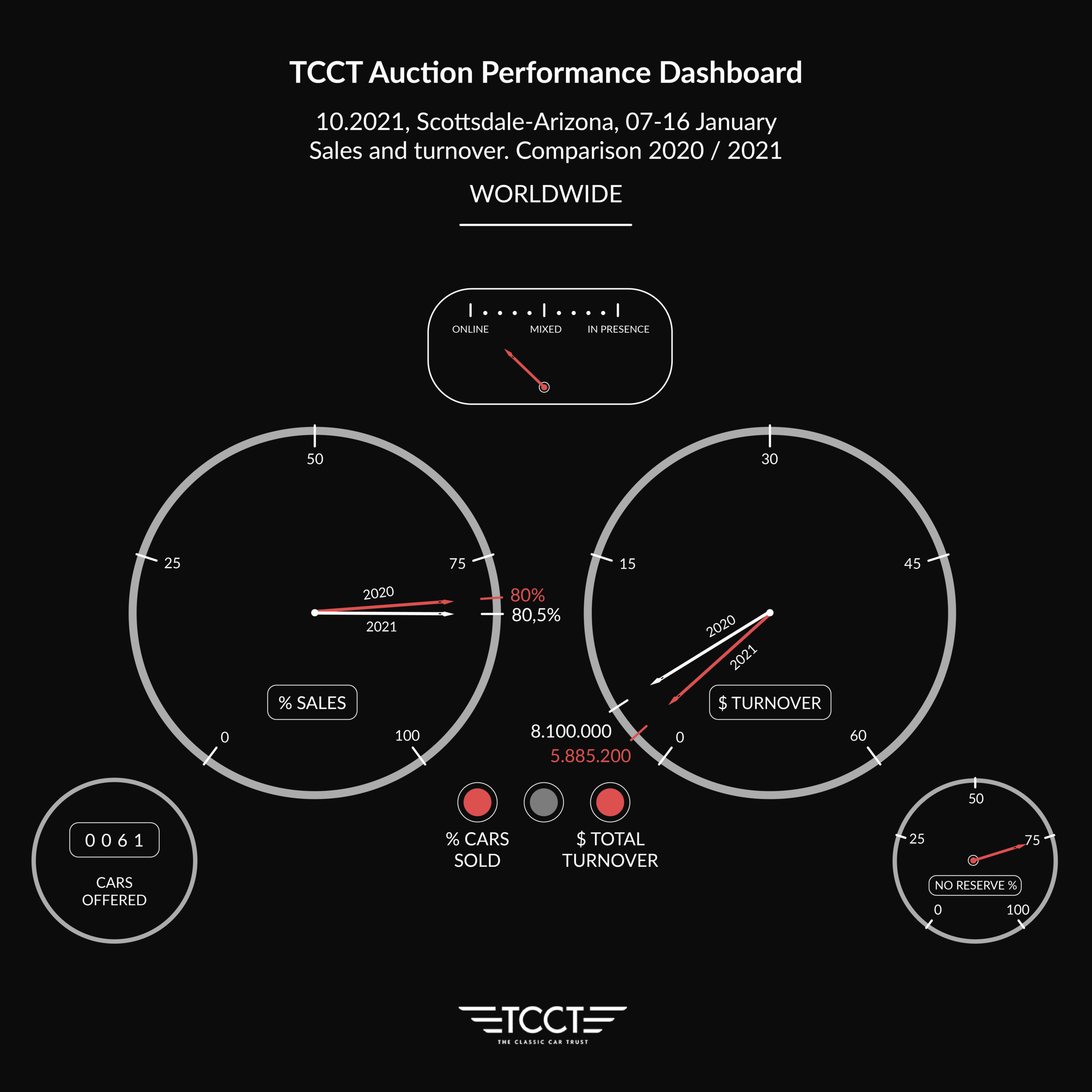

Worldwide should be considered a “special category” because we still do not have the official data and therefore we will have to comment on what we saw during the sale. There was no reason to travel to the other side of America for this auction. Despite this, Worldwide took home $4.77 million (-10% compared to the $5.3 million results of 2020) but also managed to secure a sales rate of 80.4%, thanks in no small part to the fact that 46 of the cars on offer were without reserve (out of 61, a “gigantic” 75%). Unlike the others, however, Worldwide was the only one that didn’t cancel any sales before this event so wasn’t able to benefit from a decreased number of opportunities. Not bad!

And so the winner is… in reality everyone here won but if we were to rank them we would award the gold medal to RM. Half the number of cars and a greater turnover? Who would have thought?

Cliff’s useful choices:

I have selected four cars from “Arizona”, one from each auction by way of an example of what we can learn from the market.

The first is the 1955 Jaguar D-Type, one of two red models, once owned by Bernie Ecclestone. In January 2018 it was offered at $10-12,000,000 by Gooding and stopped at $8,000,000 which was below the reserve price. Resubmitted after three years by RM with an estimate of $5.75-7.5 million, it was sold for $6 million. The moral of the story? When you have an easily identifiable car a non-sale leaves a permanent mark. Sometimes the wisest choice is the riskier one: the absence of a reserve price. $8 million is more than 6!

Those who work with auctions are always focused on numbers, percentages and trends and sometimes forget that cars are passion and emotion. The 1969 Triumph GT6 MkII pushed me to fantasize a little: it wasn’t a normal GT6+ but an ex-Group 4 that had won the E class of that year’s SCCA championships. In 2009, it took home another cup at the Concours d’Elegance at Amelia Island. The sale price? $68,320. What did we learn? That you don’t have to be a millionaire to buy cars that have everything including a strong history and are also “fun to drive”, you just have to know where and how to look… and follow TCCT’s advice!

Any interest in Worldwide’s auction, at least for those born and raised in the 80s, was monopolized of the Chevrolet G20 used in the A-Team TV series. It was one of six made for promotional purposes. The exterior and interior are faithful replicas of the original. True, there were some doubts over the road-worthiness of the car but the lack of reserve and the fact that the proceeds went to charity (tax deductable as a donation) pushed the car to $84,000. If it had been used in the series, it might probably have tripled that result. Be that as it may, it was a beautiful object.

During the opening speech of the World Economic Forum in Davos, Chinese President Xi Jinping declared “winter will not stop spring.” A good concept these days, to keep in mind when we think about the 1968 Meyers Manx sold by Gooding. Dune buggies were very popular in the 1970s but were put in the attic afterwards. Be that as it may, they are a lot of fun to drive without fearing any boundaries. It would appear that this simple invention is coming back into vogue given the increase in prices: this example was estimated at $40-60,000 but in the end the price rocketed all the way to $101,200 or, if you prefer, 655,000 Chinese Yuan…