Photo credit: Mecum

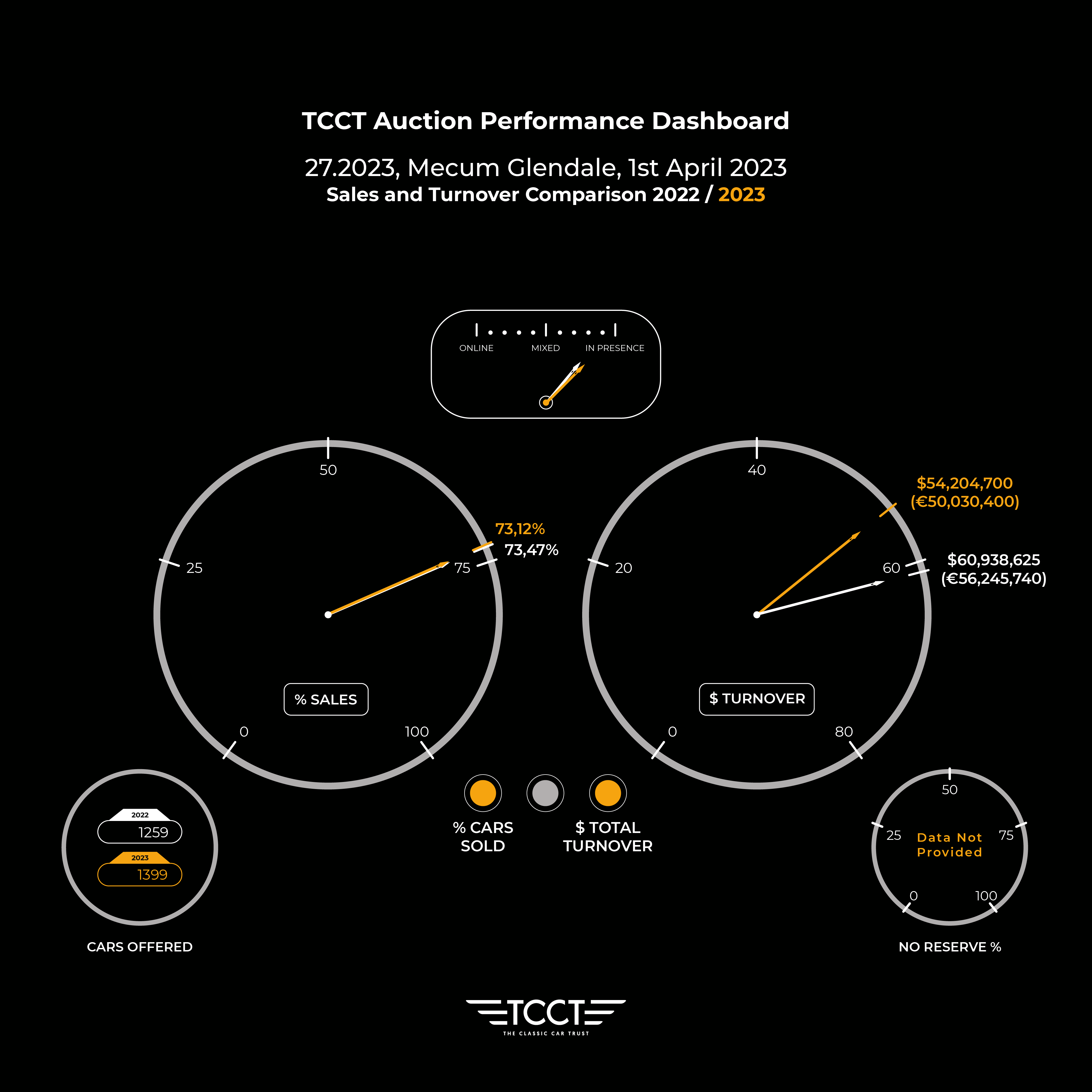

Despite the recent bankruptcies and banking risks, the Mecum auction in Glendale seemed unaffected by the cold wind blowing across the market. Looking at the numbers, there doesn’t seem to be any significant cause for concern: there were 1,399 cars at the auction compared to 1,259 last year, with 1,023 sold in 2023 vs 925 in 2022, and a stable success rate of 73%, identical to that achieved 12 months ago.

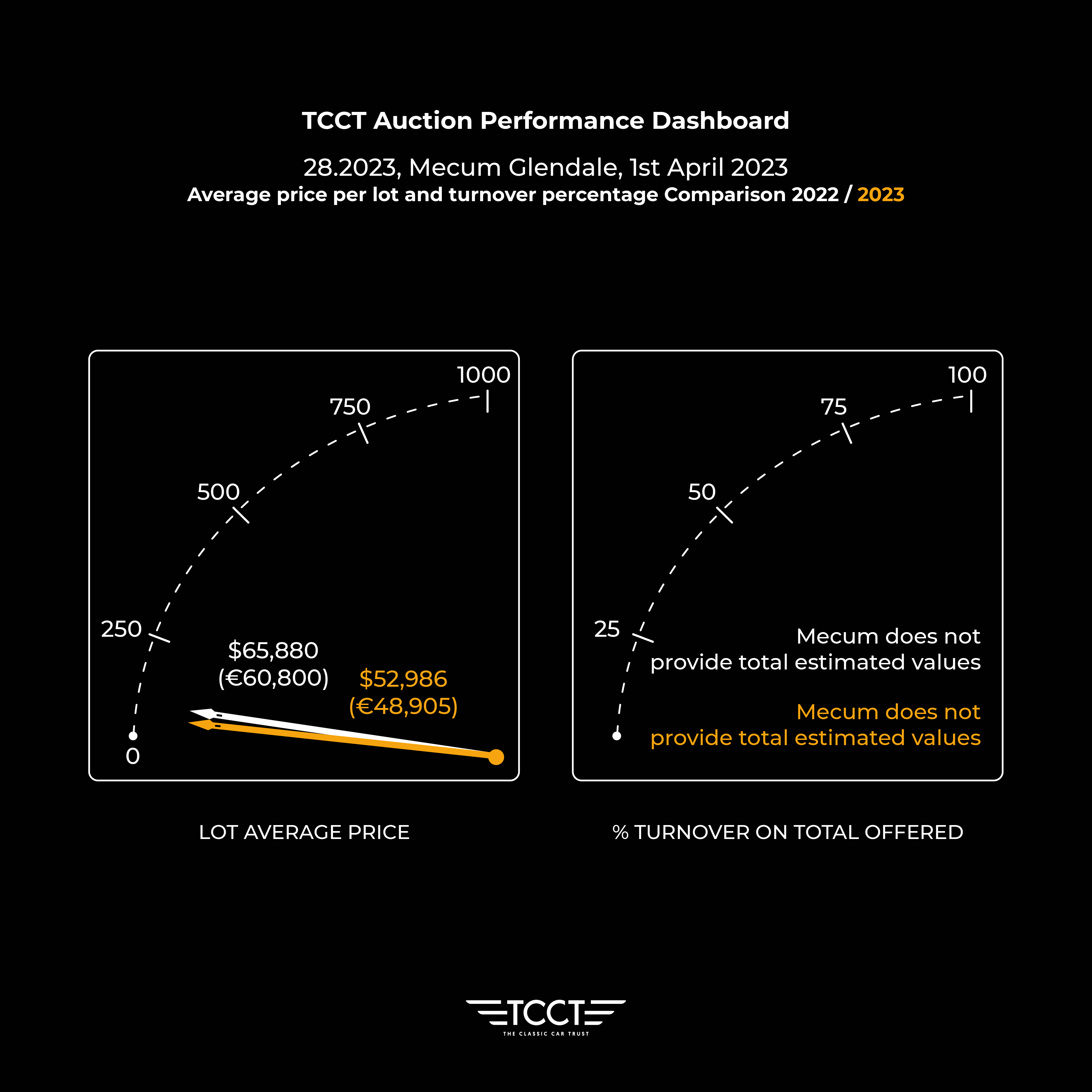

The only difference is in total turnover, which fell by approximately 11% from $60.9 million (€56.2m) to $54.2 million (€50m), with almost a 20% decrease in the average price from $65,880 (€60,800) in 2022 to $52,986 (€48,905) in 2023. However, it is important to note that one or two unsold top lots could easily have impacted the overall picture. And that’s exactly what happened.

The best thing to do here is let the analysis of certain cases shed some light on the overall market trend:

Let’s take our classic reference point, the Ferrari F40, for example. At the auction, a 1990 model with 3,413 miles on the clock (and US specification) was sold for $2,600,000 (€2,399,775). However, it’s important to note that there has been a slight but steady decline in the prices of supercars from the 1990s, as we saw in Amelia. Although the price paid here was lower than the $3,000,000 and above paid in recent months for similar models with comparable mileage, it still remains higher than the prices from one year ago. It seems to me like this is more of an attempt to take advantage of a model that will always hold solid value over time.

Another important ‘highlight’ from the catalogue was the McLaren Speedtail, which remained unsold at $2,400,000 (€2,215,175). Before moving on, it’s worth taking a minute to note that last year the exact same model was sold for $2,700,000 on Amelia Island. We have noticed on more than one occasion that these ‘frequent flyers’ often struggle to sell. Additionally, the car had only covered 275 miles since new, indicating that the previous owner hadn’t even used it – it was likely a purely commercial operation. It’s hardly surprising then, that it failed to sell.

With two supercars now out of the game, the top lot of the sale became the most interesting car to follow. Another grand classic of the market, a 1955 Mercedes-Benz 300SL Gullwing, this time in a very unique colour, Mittelgrün, a beautiful Medium Green. It was estimated at $1.85m-$2m, which is by no means a small sum, even for such a unique and particular car. As soon as I saw it, I remembered that it changed hands last September after the Worldwide auction in Auburn for $1,700,000. Considering that the market doesn’t favour ‘frequent flyers’ (see above), the final sale price of $1,815,000 (€1,675,225) wasn’t a bad performance at all. Returning briefly to the concerns about the events affecting some major banks, we can confirm that iconic car models are more stable and reliable than certain banks that can stumble and even collapse from one day to the next.

The same reasoning applies to relatively more modest investments, such as the 1969 Chevrolet Camaro Yenko 427/425 (not the very rare and expensive SuperYenko 427/450). The one for sale at Mecum was finished in Rally Green with a black vinyl top and was in excellent condition. Throughout 2022, the price of this model ranged from $230,000 to $407,000. Mecum estimated it between $300,000 and $350,000, and the final sale price of $363,000 (€335,000) confirmed the model’s stability.

Moving on to the more sparkling part of the market, there were a number of attractive deals to consider. Personally, I was enamoured with a 1954 black and white Chevrolet Bel Air, despite it not being as famous as the 1957 model. While the sober colour was not your typical 1950s-style, the car was in perfect condition. It had been painstakingly preserved right down to the very last bolt, earning it an AACA award. This car was an embodiment of the ‘average’ American family vehicle of the time – a glimpse into a bygone era. And the best part? It was sold for a very ‘reasonable’ $29,150 (€26,900).

Next up was a 1954 Bel Air Convertible, which had a more attractive colour but lacked the well-preserved charm of the previous car. The price was slightly higher, but it was still less than my neighbour’s SUV (although this classic car had much more style than their washing machine): $38,500 (€35,500).

Finally, let’s talk about ‘bang for the buck’. Here, the 2010 Maserati GranTurismo Convertible was probably unbeatable in this category. With its 4.7 litre, Ferrari-derived engine producing 435 horsepower, and having covered just 48,000 miles, it was an incredible deal. The burgundy exterior with a light cream interior was simply magnificent! Rarely have I seen such a successful combination of a car’s personality and its colour scheme. Although the estimated price was between $30,000-$40,000 (without reserve), someone managed to take home an absolute bargain for just $22,000 (€20,300).