Photo credit: RM Sotheby’s

It’s interesting to see how a thriving market always knows how to adapt and realign itself with the changing times: taking an in-depth look at the Gooding auction, it becomes immediately clear how certain car categories have reached a plateau after a period of vigorous growth. That’s perfectly normal in a healthy market, but it should nevertheless be taken into consideration. On the contrary, there is a growing interest in long-neglected models that have found unexpected attention.

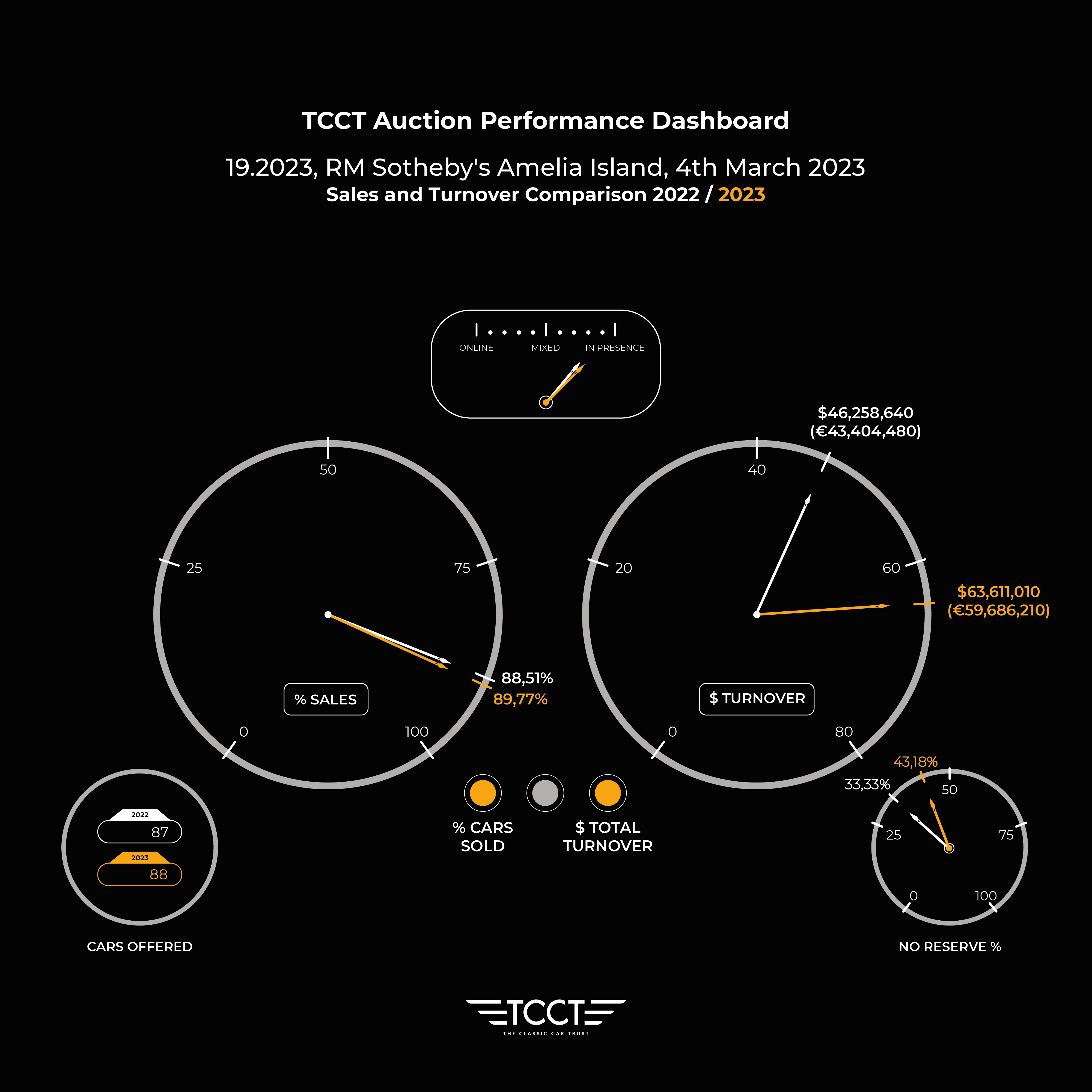

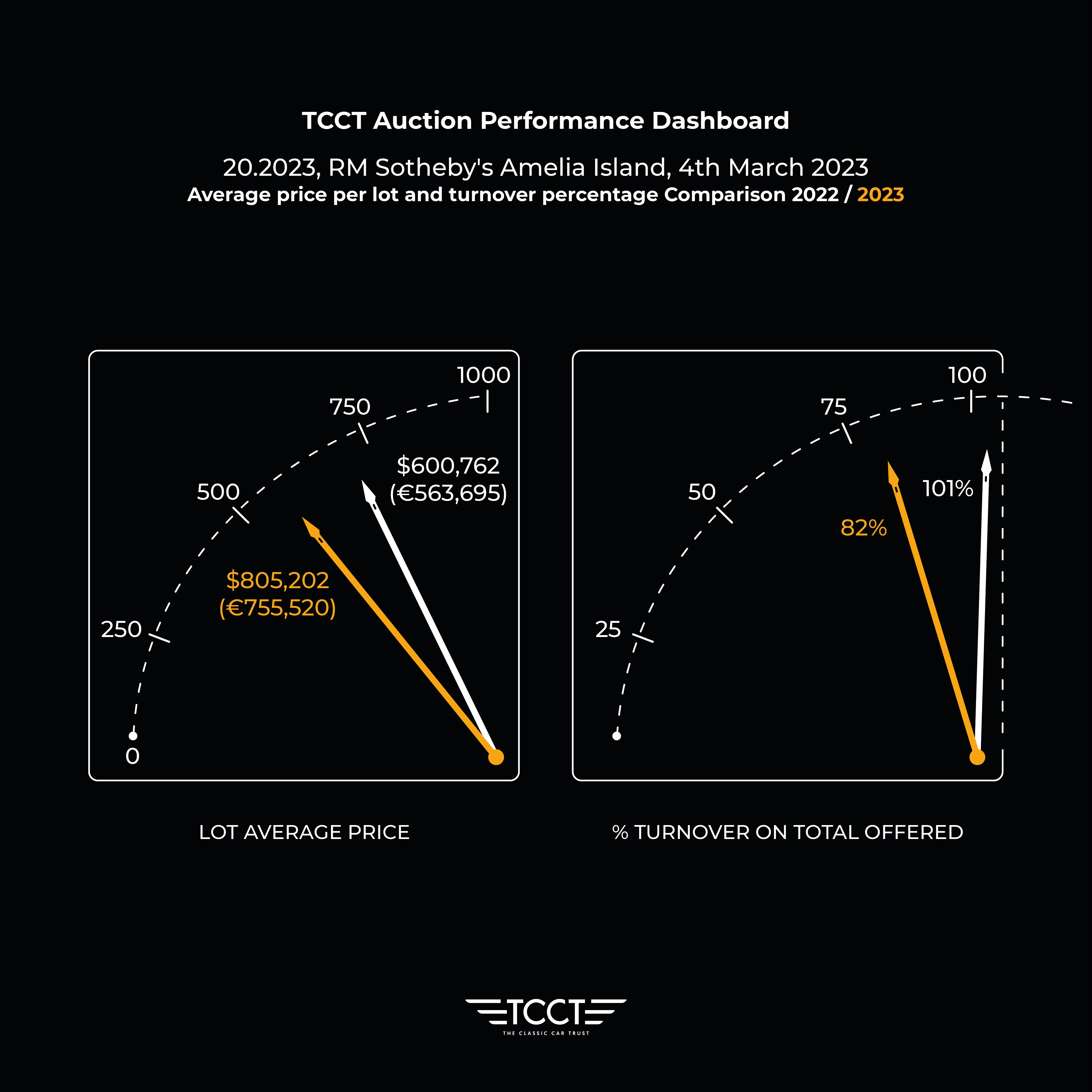

Looking at the data, RM brought more or less the same number of cars to the event (87 last year, 88 this year) and sold (77 compared to 79) with a success rate of almost 90%. Takings from sales were less vigorous than expected, however: $63,611,010 (€59,686,210) sold, up 37% on last year’s result, but nevertheless well below the estimated 70% rise. The fact that the Top lot went unsold – certainly not a good sign – played an important role there even though it was sold after the event.

Chapeaux to Rob Myers, the founder of the Auction House, who wanted to show that it is not true that traditional auctions are pompous and austere by coming up on stage wearing a T-shirt emblazoned with the words “what drives you” combined with three cars.

The first analysis I want to do is on the world of Ferraris: sold after the auction the 1959 Ferrari 250 GT LWB California Spider (estimated $9m-$11m).

What serves as a barometer for the market, however, is the second car: a Ferrari F50 from 1995. One of the very first produced, with Ferrari Classiche certification and just 1,342 km/835 miles on the clock from new. The estimate of $4.75m-$6m was fairly accurate as it changed hands for $5,065,000 (€4,752,500). Let’s take a quick look at the market: the current record ($5,395,000 or €5,045,500) was set in December for an example with 625 miles on the clock, while at Pebble Beach, another was sold for $5,175,000 (€4,839,650) despite having covered roughly 5,000 miles. Amelia’s car was more comparable to the one sold in Paris last March: 1,318 km for $4,449,950 (€4,161,600). In my opinion, the Ferrari supercar market grew until August/September 2021 but appears to be showing signs of a retrenchment.

Two other blue-chip investments at the auction confirmed my theory: a 1985 Ferrari 288 GTO with 8,000 km on the clock changed hands for $3,965,000 (€3,720,350), below its estimate of $4m-$4.5m. The highpoint of this model was reached at Pebble Beach where an example with 15,000 miles on the clock was sold for $4,405,000 (€4,119,550). But caution is advised: following this, two examples were offered but not sold.

Finally, one of our trusty benchmarks: the Ferrari F40 reached $1,875,000 (€1,759,300) against an estimate of $1.8m-$2.2m, the lowest amount since August 2021. In this case, it should be said that the condition of the car made all the difference: with 45,000 km under its belt it was the highest mileage F40 of all.

Now let’s take a look at the other part of the RM auction: the most expensive car of the whole sale was a 2010 Pagani Zonda R converted to ‘Revolución Specification’ in December 2014. Although the sale price of $5,340,000 or €5,010,500 (pre-sale estimate $4.8m-$6.8m) is the new record for the brand, given the lack of any comparison parameters, I have to say that this car is more suitable for TikTok than TCCT.

Now an interesting example of strategy in action: January 2018, Arizona. A white 2014 Mercedes-Benz SLS AMG Black Series Coupé was offered at auction. It was a beautiful example of a modern supercar; lots of accessories, one owner, just 611 miles from new. The estimate was just right at $425,000-$475,000. The owner, however, decided to keep it moments before the auction. Five years pass and it’s once again placed under the hammer, this time with 616 miles (five more). The owner assumes that the market has forgotten the facts of five years before but the TCCT “brain” immediately launches an alert: follow it! The estimate this time had almost doubled: $800,000-$1,000,000, and it sold for $940.000 (€882,000).

In contrast, the 1965 Aston Martin DB5 presented at Pebble Beach in August 2022 with a valuation of $1.6m-$1.8m, stopped at $1.4m and the owner refused to sell it. Nine months pass and he decides to accept a new estimate: $1.2m-$1.5m. It ends up selling for $1,352,500 (€1,269,050).

What do these two stories teach us? First of all, the Mercedes-Benz was withdrawn before the auction and was not unsold. Second, the time difference in important: offering an object after five years is not the same as re-proposing the same object – which went unsold – after just a few months. Often accepting the offer is the best solution (and would have earned the owner of the Aston almost $200,000). The other adopted a far superior strategy.

The most inexpensive car in the catalogue is also one worth mentioning: I am a huge fan of the Porsche Boxster and several times I have come this close to buying myself one, so I speak with some experience. The one for sale at RM’s was fantastic: a more powerful S version, with only one owner and just 4,522 miles on the clock. The reason I wouldn’t have bought it? The Violet Metallic colour and the equally rare Aero kit, which ruined its clean lines. However, it was estimated at $20,000-$25,000 and was sold for $39,200 (€36,780). If I had been there…

Before closing, I’d like to take a quick glance at three cars that have reshaped the market: the Shelby Cobra 289, which sold for $1,655,000 (€1,552,885) against an estimate of $900,000-$1,200,000, a record for a 289 road-going Cobra.

The blue Ferrari 308 Fiberglass, estimated at $225,000-$275,000 went a lot further than that, changing hands for $313,000 (€293,685), a new record that also confirms that red is no longer mandatory for Ferraris.

Finally, the 1936 Lancia Astura Series 3 ‘Tipo Bocca’ Cabriolet by Pininfarina. A pre-war car offered at a Concours d’Elegance is particularly attractive but at $2,205,000 (€2,068,950) – exactly in the middle of its estimate of $2m-$2.4m – it’s the most expensive Lancia ever sold.