Photo credit: Bonhams, Broad Arrow Auctions

The sales of Broad Arrow Auctions and Bonhams on Amelia Island have been placed side by side because at first glance, they look very similar.

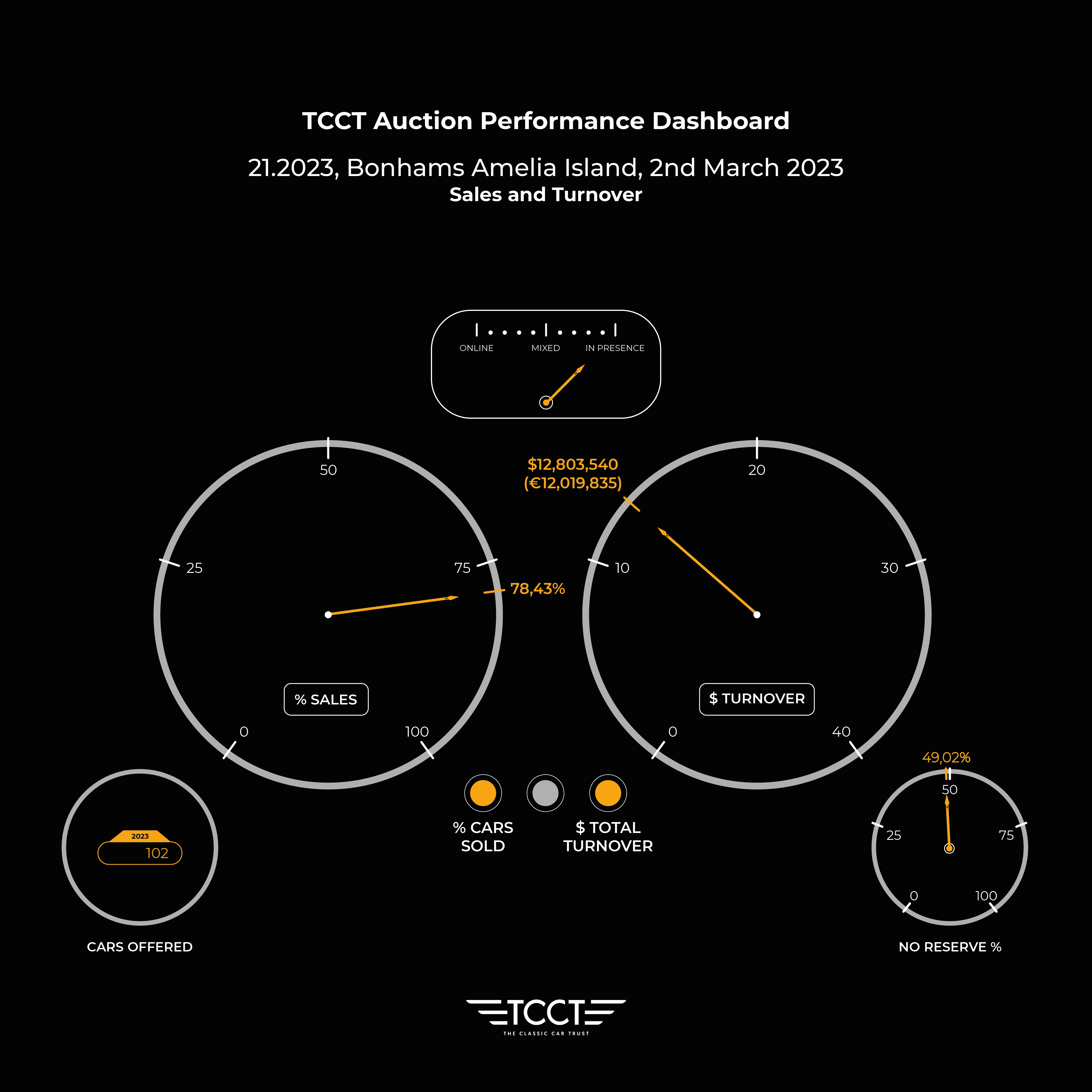

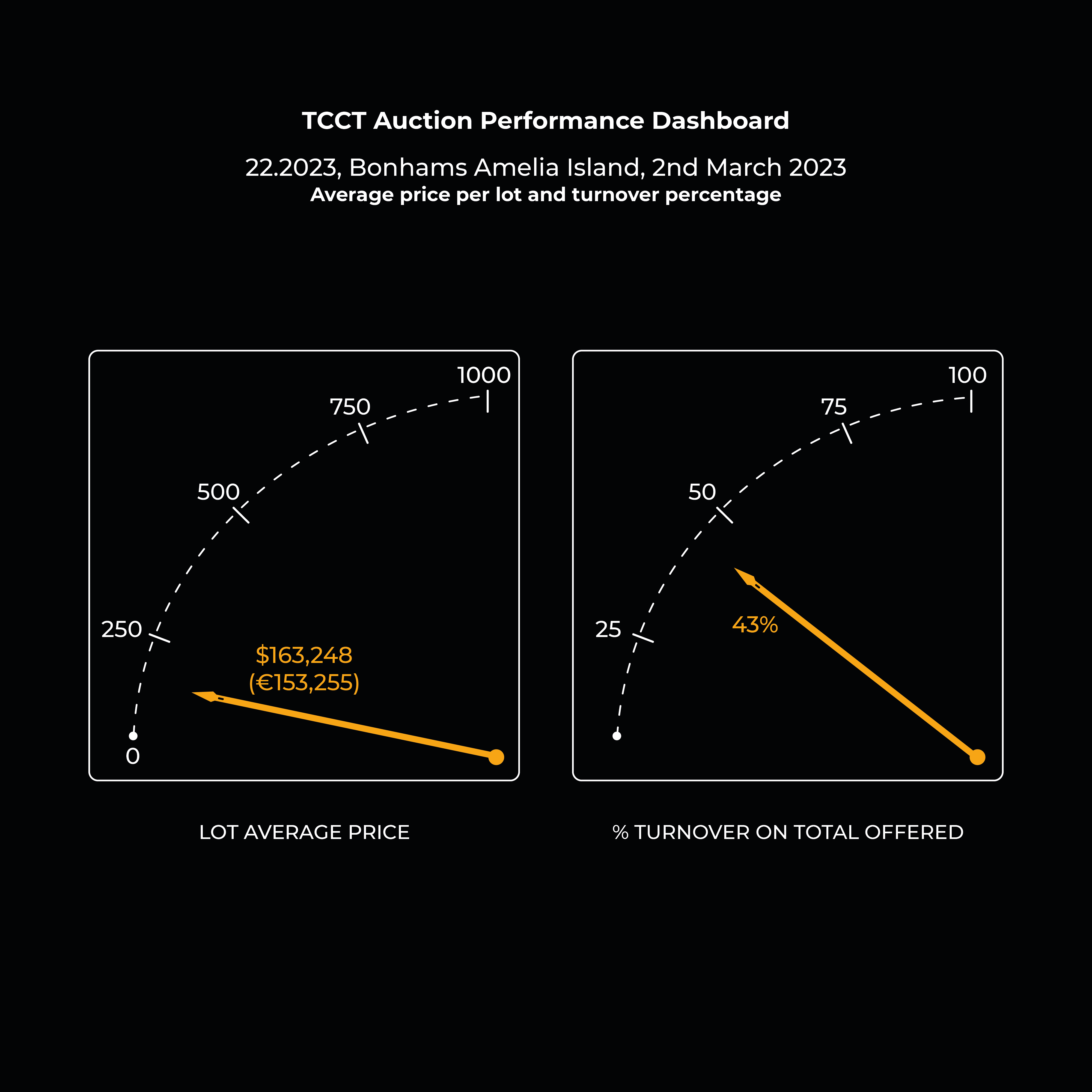

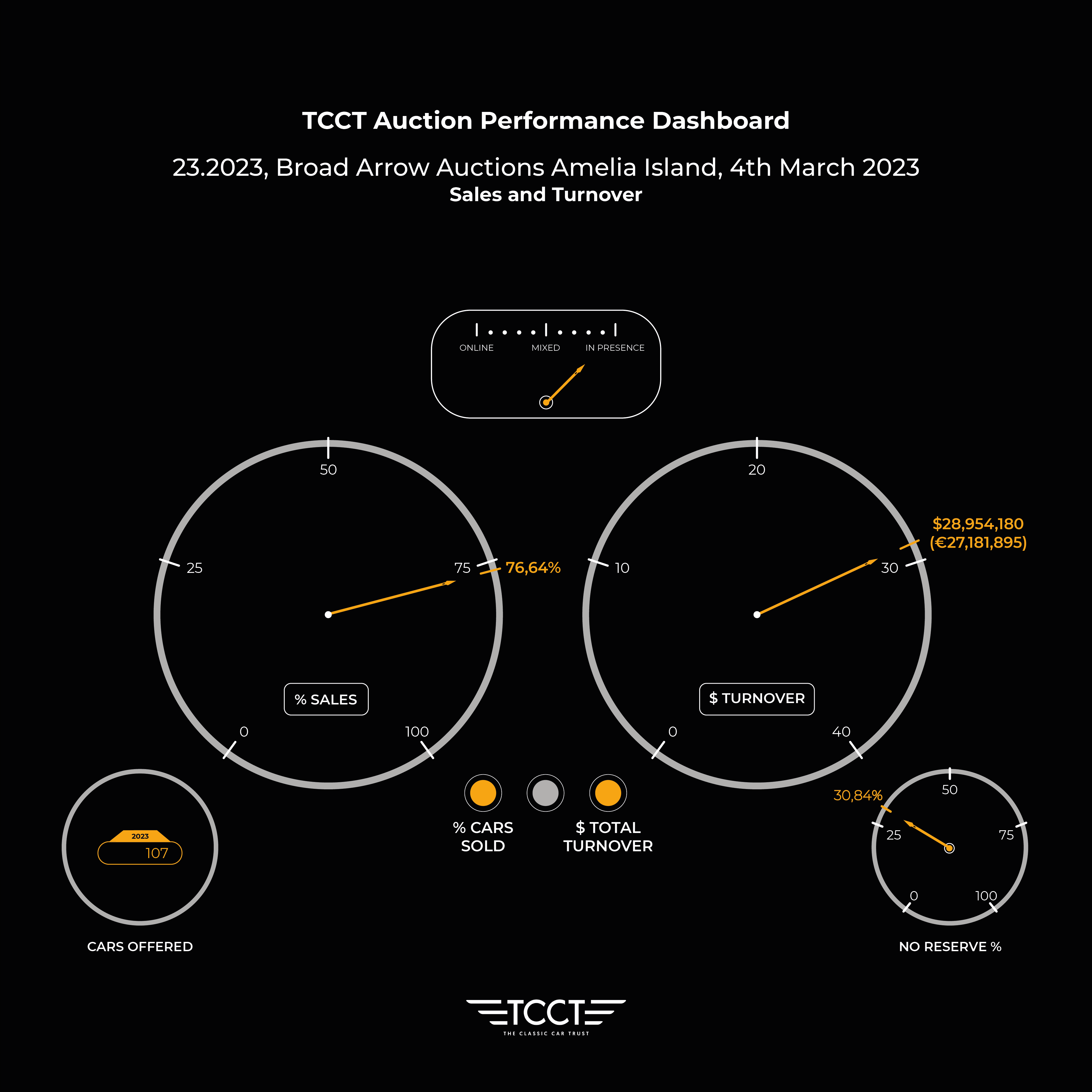

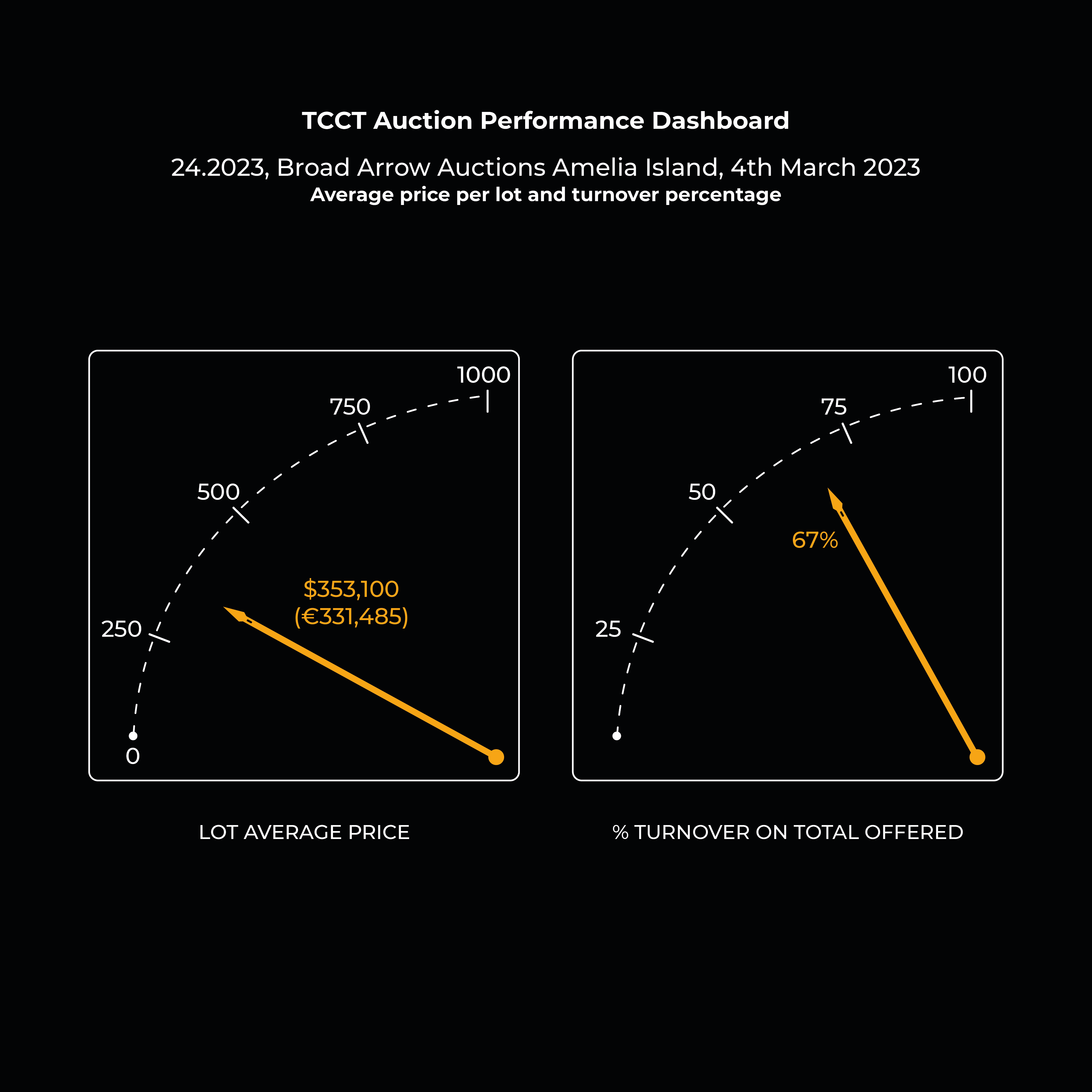

Bonhams brought 102 cars to their event, while Broad Arrow offered 107. The potential revenue for the British auction house was estimated at $29,754,000 (€27,932,755), while Broad Arrow was expected to bring in slightly more at $43,200,000 (€40,555,725). However, there were some notable differences. Broad Arrow is a part of The Hagerty Group and is relatively new to the game, while Bonhams has a decade of experience under its belt. Additionally, the number of cars without reserve also differed significantly, with Bonhams having almost half of their catalogue without reserve, while Broad Arrow had less than a third.

Paradoxically, when the lights went out, the actual results of the auction were the opposite of what everyone had predicted. Despite BAA having a slightly lower percentage of lots awarded, at 76.64% compared to 78.43% from the British, the final value of the sales was diametrically opposed. The Americans brought in a total of $28,954,180 (€27,181,895), more than double the amount taken by the British: $12,803,540 (€12,019,835).

In essence, Bonhams focused on selling cars without reserve, while Broad Arrow primarily dealt with cars with one. Interestingly, neither auction house experienced any significant issues related to the serious problems of the Californian or Swiss banking systems.

It’s interesting to note how commercial marketing can be built on unfortunate experiences. Take, for example, Bonhams who brought a 1937 Bugatti Type 57S Sports Tourer, which was bodied by Vanden Plas. With an estimated value of $10m-$12m, it may have been tempting for buyers, especially considering that it had been purchased for $9,735,000 at the same auction in 2016, a record-breaking amount for a Bugatti at the time. However, these types of cars aren’t practical for everyday use, as they’re too delicate for both the track and the road. Instead, they’re typically reserved for showcase events like Concours d’Elegance. This particular car had been exhibited at several prestigious events, including Pebble Beach, Amelia Island and another half dozen world-class meetings, but the market was hesitant to spend $10 million just to win a local contest. As a result, offers for the car stalled at $8,500,000 (€7,979,715), and the market decided to wait a few years before trying again.

There were numerous cars that achieved remarkable success, but one in particular stands out: the 1951 Jaguar XK120 LT3 Works Lightweights Sports Racer. After winning at Le Mans in both 1949 and 1950, Jaguar was concerned that their new C Type model wouldn’t be ready in time for the upcoming race, so in order to keep the flag flying high, Jaguar decided to lighten three XK120s, one of which was the very car offered by Bonhams. Despite remaining in the hands of the same owner for almost half a century and needing a complete restoration, it was estimated to be worth between $400,000 and $600,000, which seemed very high. Instead, the car’s rich history captured the hearts of bidders, and it ultimately sold for an impressive $775,000 (€727,550).

Broad Arrow’s cars tended to be significantly younger than those of Bonhams, with an average age of 46 compared to 60. This worked to their advantage, as demonstrated by the sale of the 1991 BMW Z1 Roadster in Violet Metallic with only 19 km on the clock. The car had previously sold at auction in Belgium in 2021 for a record-breaking €105,800 (a record for the model). Just 18 months later, on the other side of the Atlantic, it changed hands for $128,800 (€120,915). While the seller may have made a profit on the sale, it’s likely that the various fees associated with the transaction, such as commissions, transportation, and customs, may have eaten into any earnings, leaving them with little change to spare, or perhaps even resulting in a loss.

The 1997 Acura Integra Type R was a car that really caught my eye. For those who grew up dreaming of the sports cars on their PlayStation, this car was legendary, with its iconic livery, white rims and the scream of its powerful VTEC engine. Drivers of the time considered it to be the ultimate car. That’s why the one offered at Broad Arrow was so exciting to follow: only 6,220 miles on the clock and owned by the same person until 2019. While the estimated value of $90,000 to $120,000 was already high (and nearly double the current record for a physical auction), the bidding quickly soared past 9,000 rpm: sold for $151,200 (€141,950).

With numbers like that, the 1994 Aston Martin Virage Volante seems like a bargain, costing more than an Acura at the time, as well as being faster, more luxurious and, ultimately, rarer. The one for sale at Bonhams, in a very elegant livery, had covered just 14,300 miles and while the estimate was quite enticing at $60,000-$80,000, it ended up being sold for $64,400 (€60,450). Now I am a huge fan of the Acura, but paying two and a half times more for it than for an Aston Martin seems a little excessive.

And Ferraris? They were out in force too, of course.

Bonhams brought an extraordinary piece at the event, a 1966 Ferrari 500 Superfast S2. It had travelled less than 14,300 miles and with its original interior it was in immaculate condition. What’s even more impressive is the list of previous owners, including John Mozart, Emilio Gnutti, James Leake, and Jean Guikas. But the real compliments should go to the experts for the way they listed the car: without reserve and with a price range between $1m-$2m, which is significantly below the actual market value of around $2.5m. In fact, I was so impressed that I called it “the best deal of Amelia” in a message to a friend. The final bid of $1,930,000 (€1,811,865) was quite high but still slightly lower than my expectations. Nevertheless, it became the most expensive car sold by Bonhams.

At Broad Arrow, the 2015 McLaren P1 topped the charts at $2,425,000, but the most captivating sale was that of two Mercedes-AMG ‘Hammer’ Widebody models: a 1991 Coupe and a 1987 Sedan. These cars were once overlooked and until 2018-2019 they were valued at only $70,000-$80,000, but the rise of fashion and events like Radwood, which celebrates cars from the 80s and 90s, changed everything.

The Sedan had an estimate of $575,000-$625,000 while the rarer coupe (with just 36,700 km on the clock) was estimated between $650,000-$850,000. Bidders, however, were euphoric: $775,000 (€727,560) for the sedan and $885,000 (€830,825) for the coupe.

Finally, my personal favourite from Broad Arrow, although it went unsold, was the 1968 Porsche 907K with chassis number 25. This car was the one that triumphed at the Targa Florio in 1968 with Vic Elford at the wheel and it was also driven by Umberto Maglioli and Ludovico Scarfiotti. The only downside to this car is that it was restored more than twenty years ago by Julio Palmaz, a renowned Porsche expert, who converted it from a spider to a coupe to bring it back to its original form. Despite its few flaws, the car failed to reach its estimated price of $4.5m-$5m, and the bids stopped at $4m (€3.7m). One can’t help but wonder if the recent collapses of Silicon Valley Bank and Credit Suisse, and the subsequent fears of global instability, played a role. Or perhaps, it could be that Amelia’s auctions are simply not suitable for real racing cars. Perhaps if it is presented at the Porsche 75-year auction, things will be different.