Photo credit: Bonhams, Gooding, RM Sotheby’s, Mecum

The collapse of the international classic car auction market in 2020, when the pandemic threatened to bring with it a long and hard-felt economic crisis, brought down the values and quantities of cars sold to the same levels as 10 years ago. This violent and sudden demise was exacerbated by the impossibility to organize physical auctions in presence, replaced in extremis by online equivalents which, against all the odds, achieved the hitherto unthinkable: large-scale adoption by the large auction houses.

The powerful boost given to the economy and to private individuals by the Biden administration in the US and by the Next Generation EU fund, combined with an unexpected and rapid recovery of the world economy, paved the way for a spectacular market revival in 2021, with final numbers that even managed to exceed the already excellent results of 2019, the last year before the pandemic struck.

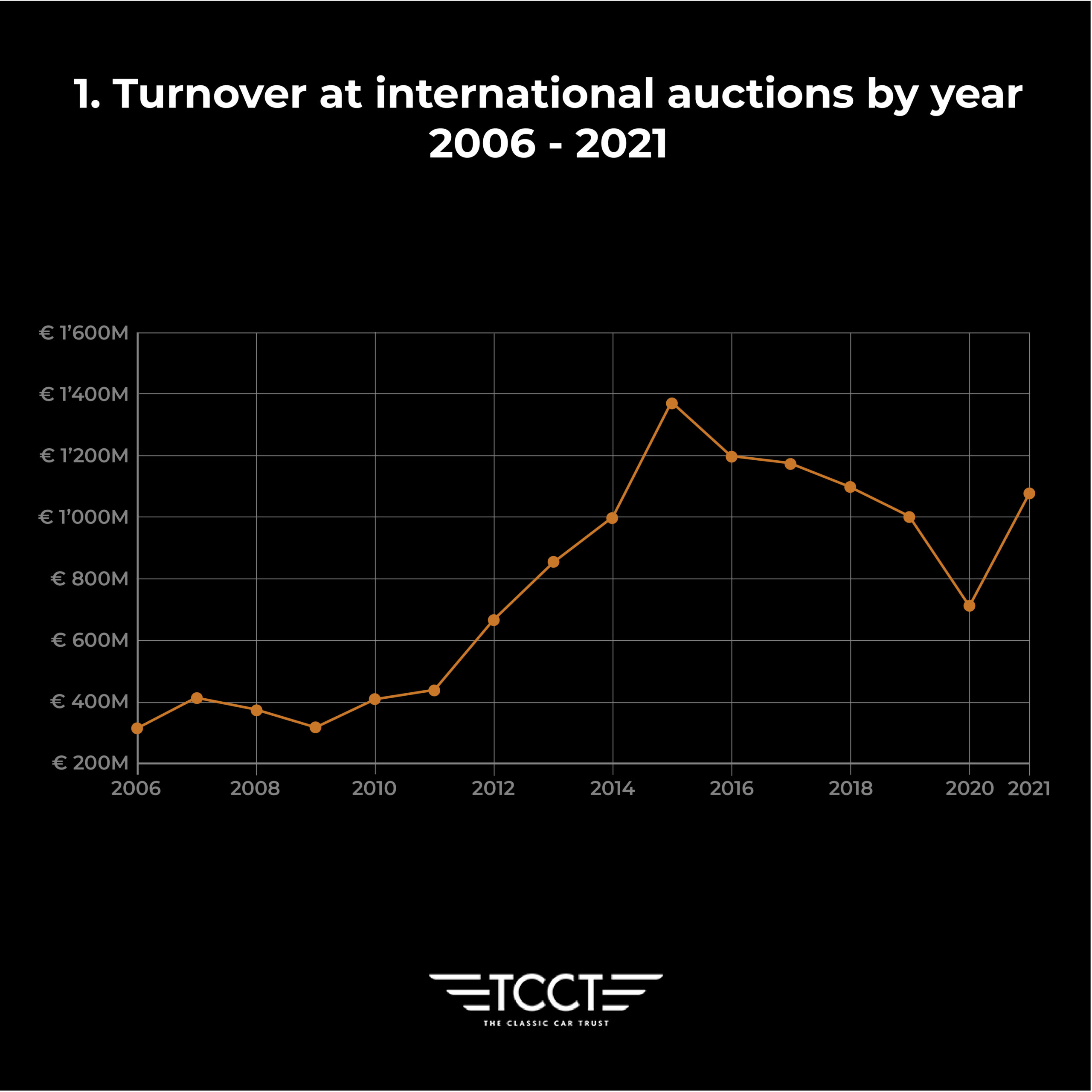

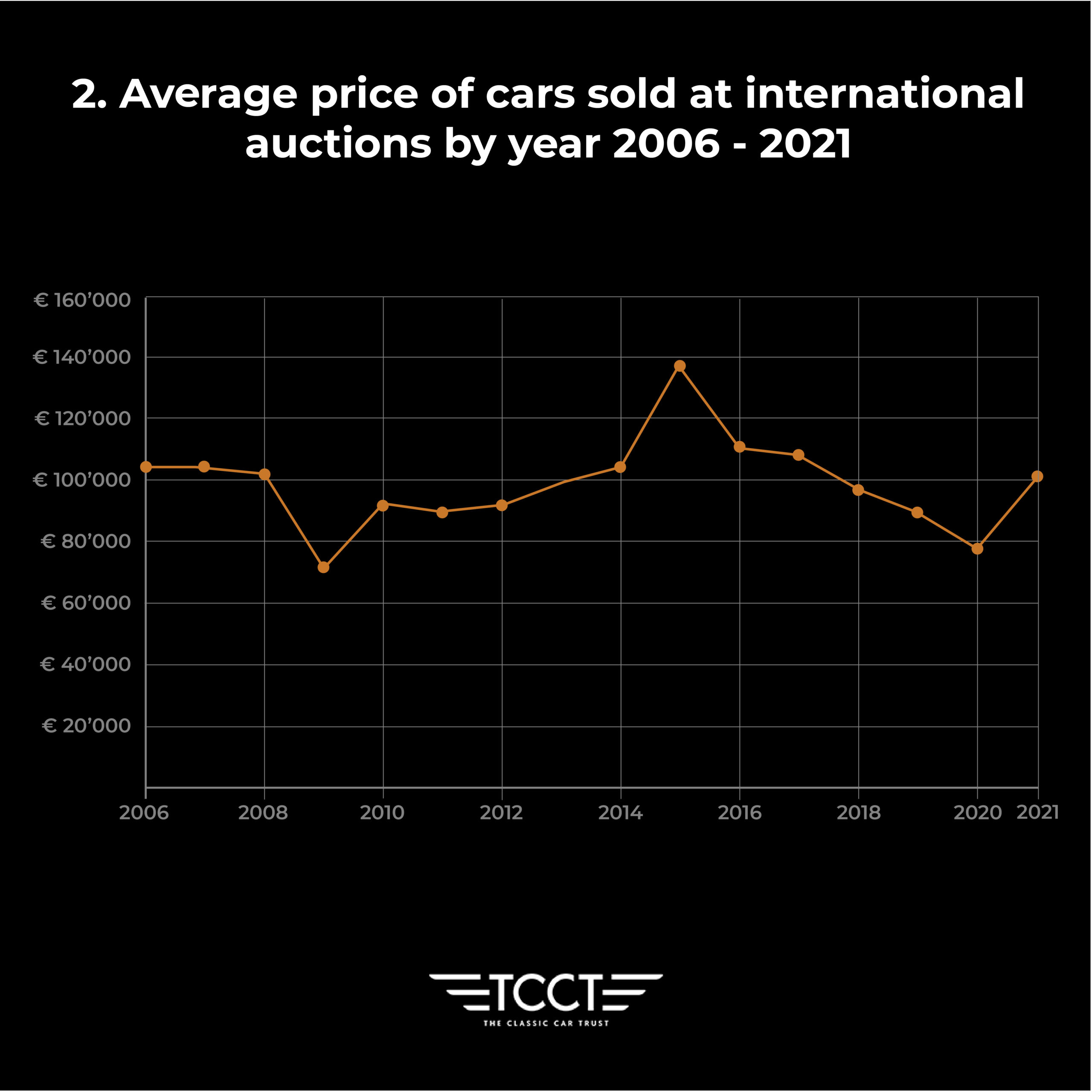

A few figures to put this into perspective: compared to the turnover of €997 million generated by the auction houses in 2019, and a drop of 28% in 2020, totaling just €714 million, 2021 closed with a jump to €1,039 million, as illustrated in Figure 1. And that’s not the only positive fact. This result was achieved with a lower number of cars sold: 10,185 compared to 11,455 in 2019, with average prices consequently jumping from €87,000 to €102,000 as indicated in Figure 2.

There is, however, a caveat: past average prices, which in some years were even higher in addition, not to mention the exception of the 2015 boom, were based only on in-person auctions. This means higher prices than those of online auctions which, in 2021, were held alongside traditional auctions, confirmed by the fall to €79,000 per car in 2020, where the majority of auctions were in this format.

So what about online auctions today? They have become a reality that potential customers consider much more than they did before. Above all, thanks to the fact that even the large auction houses dipped their feet in the online auction waters, bringing with them the attention of many who had never considered them beforehand.

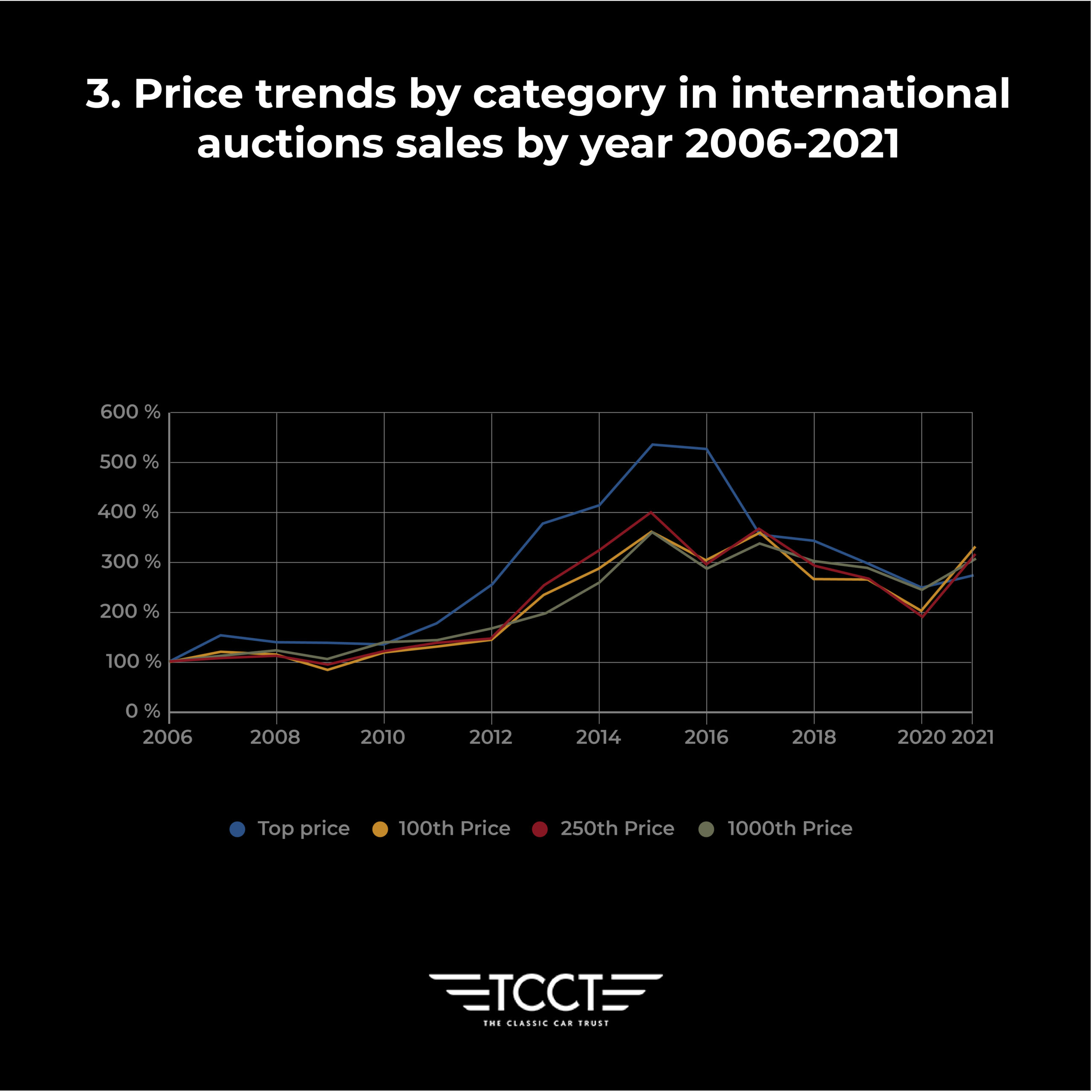

And this applies both to those who wish to buy as well as those looking to sell, because with online auctions, commissions are much lower. This phenomenon is illustrated in Figure 3, where the curve representing cars priced at low-medium levels grew less than the more expensive models which are traditionally sold at face-to-face auctions.

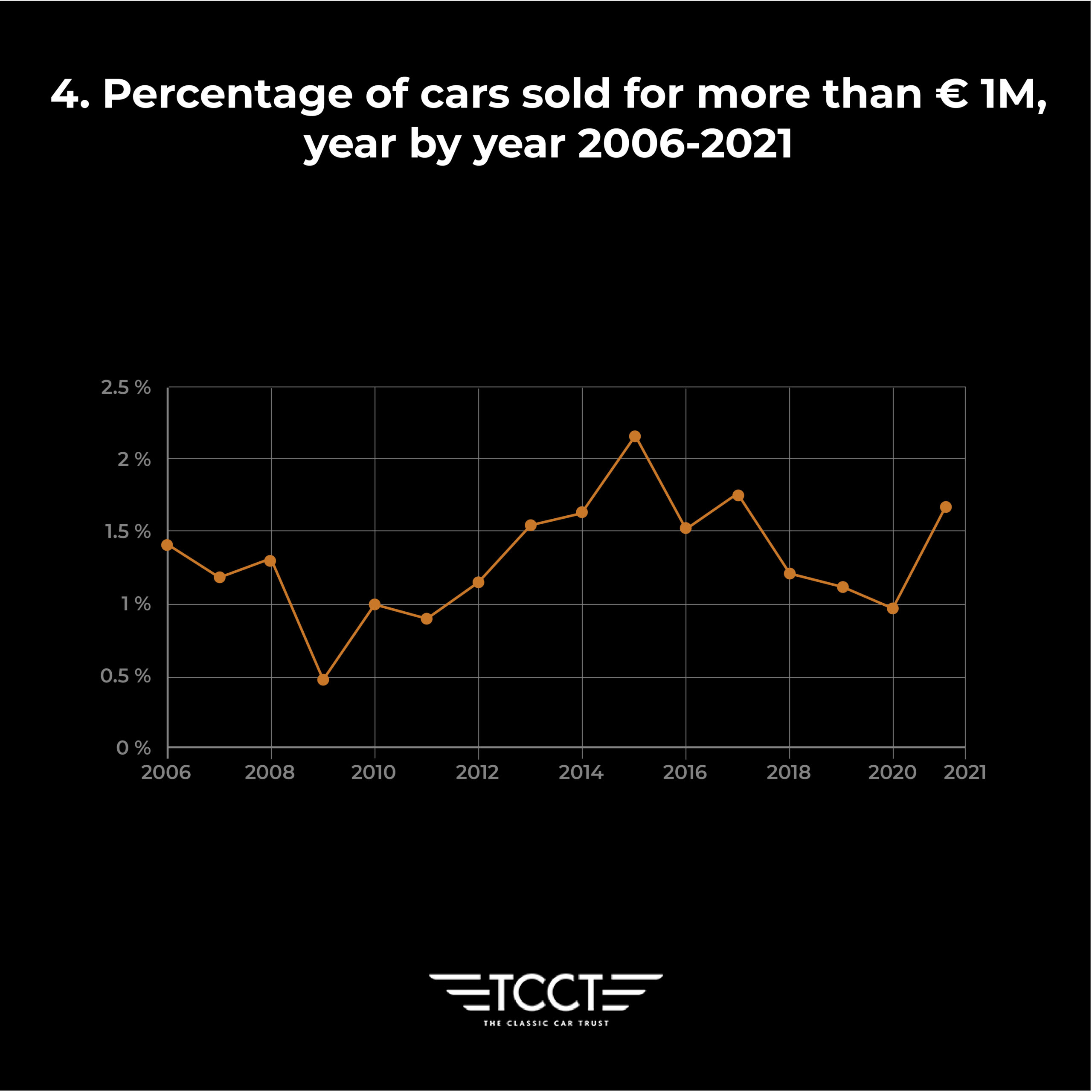

A final figure that confirms the liveliness of the market recovery can be seen in Figure 4, which indicates the still very low percentage of cars sold for over one million Euros: 1.52%, which is almost double last year and at decidedly positive levels even in comparison with the past.

An in-depth analysis of the Classic car market over the last 15 years has been published in The Key, Top of the Classic Car World 2021, which can be ordered here.