Photo credit: Artcurial

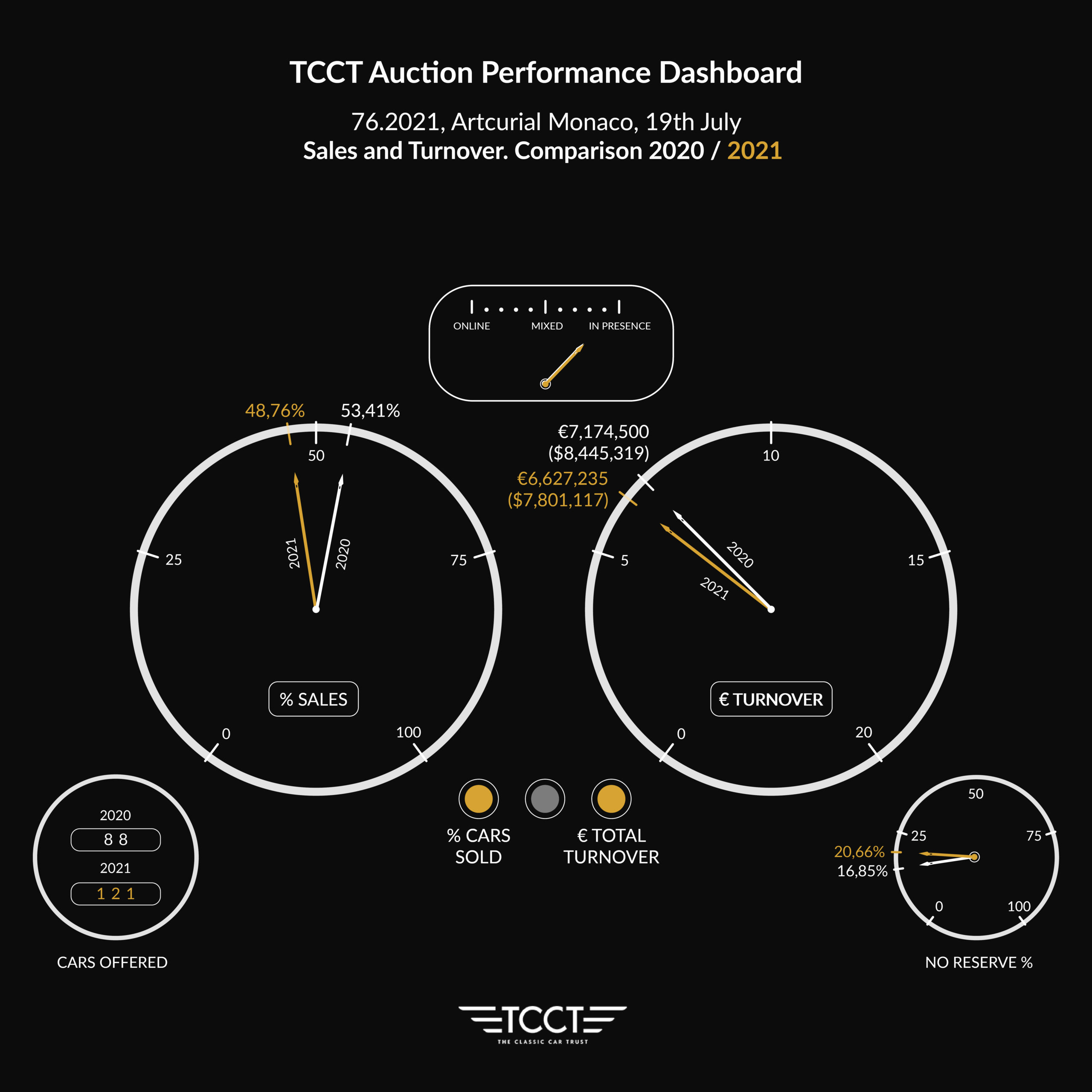

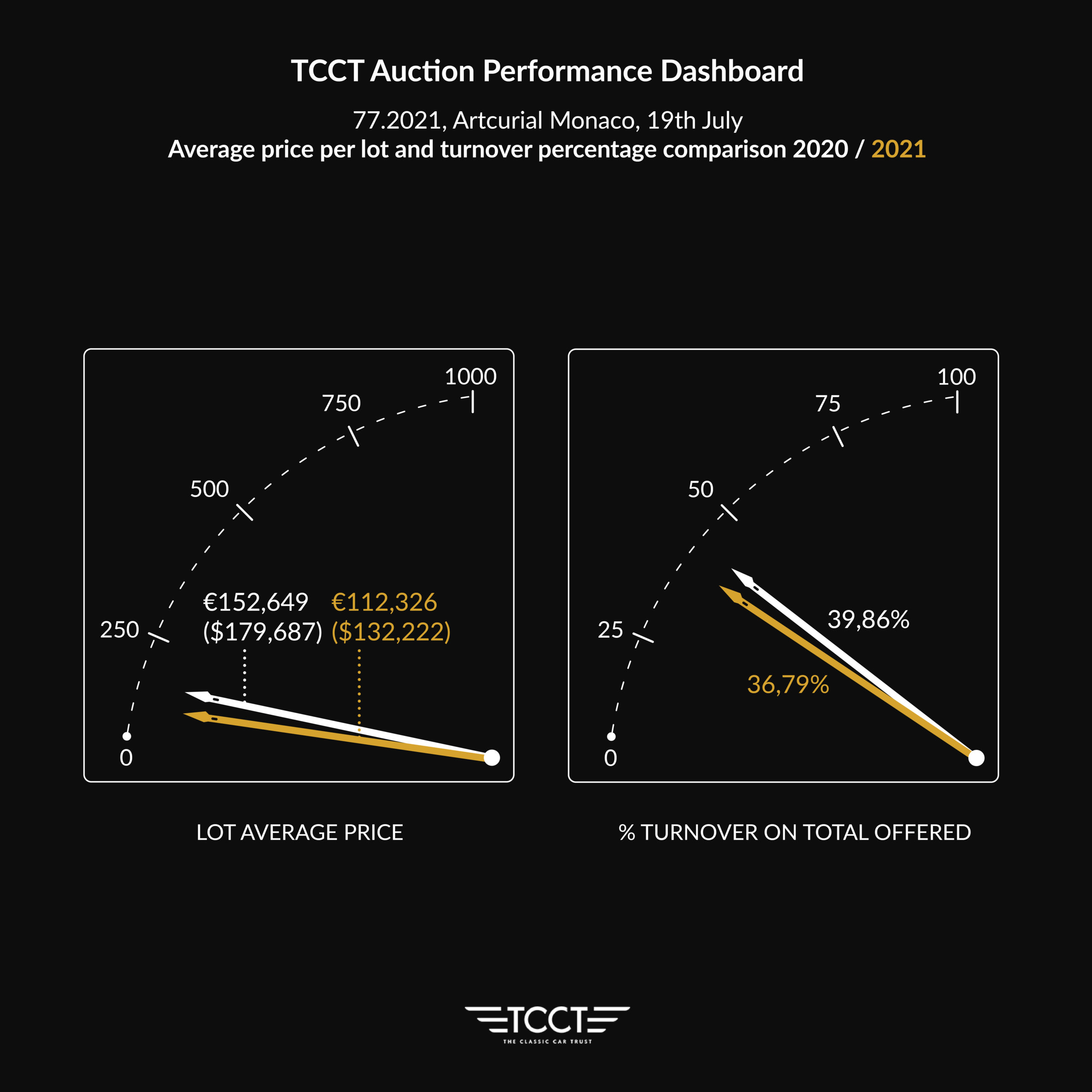

On 19th July, Artcurial held its second sale of the year with the aptitude this auction house is famous for: 121 lots on sale against 88 of last year (+37.5%) but the fear of a fourth wave – which materialized after a few days when France introduced the mandatory Green Pass – kept many hands down.

This is one justification, the other is that there was no connected car event in in Monaco, and this impacted the results. Although the number of cars sold rose from 47 to 59 (+25.5%) because there were more cars on offer, the percentage of sales fell by 53.41% to 48.76%.

Even the total takings decreased over last year: (-8%) equal to €6.627.235 ($7,801,117). In short, a step backwards from all the indicators that have emerged from the recent auctions.

Let’s attempt to analyse the trend of some of the lots to understand the behaviour of the bidders.

Starting from the top lot: a Lamborghini Miura P400 from 1968. A good example, restored in 2005, unfortunately the white exterior with black interior didn’t truly represent the car’s irreverent nature. At €977,440 ($1,156,925), it was sold well within its estimate, which put it at somewhere between €850,000 and €1,200,000.

But it was another car that aroused more interest for me. A 1977 Ferrari 512 BB carburettor. Not in absolutely perfect condition: rarely used since 1994 and in 2005, it was set aside definitively. Although apparently beautiful, surely under skin it required a restoration. Hence the reason for the decidedly low estimate of €110,000-€150,000. Considering the bearish trend for this model in recent years, one had to wonder how far it would have arrived. Definitely a good result at €146,616 ($173,550).

For a similar amount, you could have taken home a 1985 Renault 5 Turbo. Example n. 843 of the first series, it had travelled just 36,000 km since new. With the very rare combination of a black exterior and tobacco interior, this example had just one owner from 1984 to 2014, it was completely original. I have written about similar examples being sold for around €110,000 but this example was worth a little more. The estimate of €100,000-€150,000 was slightly high but in the end, it surpassed even the rosiest of expectations, changing hands for €152,576 ($180,595).

A consideration on how the market changes: five years ago a 512BB was worth 4 times a Turbo 1, now the smaller car has closed the gap. Sure, it is incorrect to compare one of the best examples of a Turbo 1 with one of the worst of a 512BB, but it is also true that even taking into account comparable examples, the difference has been reduced considerably, as quick as a decent polish.

We’ve seen some of the positives, now let’s take a look at the negatives: bad, very bad, was the result of the collection of a gentleman farmer. Five Rolls Royces and Bentleys remained unsold. The same fate, perhaps for the “drag effect” (when you lose the euphoria due to numerous unsold lots) struck the following three lots, all Rolls Royces. Another no for a nice Jaguar E-Type S1 3.8 Roadster, a car that’s very easy to sell, although this one came with a very high estimate. Optimism does not always pay off.

Let’s move on to something that I cannot fully understand in the Arcurial strategy: I’d like to use as an example one of the eight lots that suffered the same fate: the green 1968 Porsche 911 2.0 Targa Soft-Window with black interior, automatic transmission and over €135,000 spent on its upkeep. The estimate of €150,000-€200,000 without reserve was correct. And yet it went unsold. How is this possible if it was without reserve? Simply because Artcurial reserves the right to retract the car at any time. This means a lot is never really unreserved, which might discourage bidding.

Let’s see the deals of the day.

A Jaguar E-Type Series 1 ‘Flat Floor’ 3.8-Litre Roadster from 1962, black with tan leather upholstery, whitewall tyres (which suited it), completely restored, was sold for €107,280 ($126,980), slightly lower than the estimate of €120,000-€150,000. The seller accepted and the buyer was happy.

Even the 1985 Peugeot 205 T16 was a great deal at €274,160 ($292,545). Although the sale price was well within the estimate of €240,000-€300,000 with the interest Group B is generating lately, it would have deserved another couple of raises.